Calculating Zakat using OUN Zakat Report App

The Zakat Calculator used Sharia standard way of calculating the Zakat payable by each shareholder of a company. For single owner companies, a shareholder with 100 percent value for the shares count can be used. To ensure correct calculation, the user must make sure that the sum of all shareholder's [Shares Count] does not exceed 100.

Tip: The Zakat Calculator is just a report and does not make any financial transactions. Paying and settling the Zakat is not a company transaction and must be handled by the shareholder/owner outside the system.

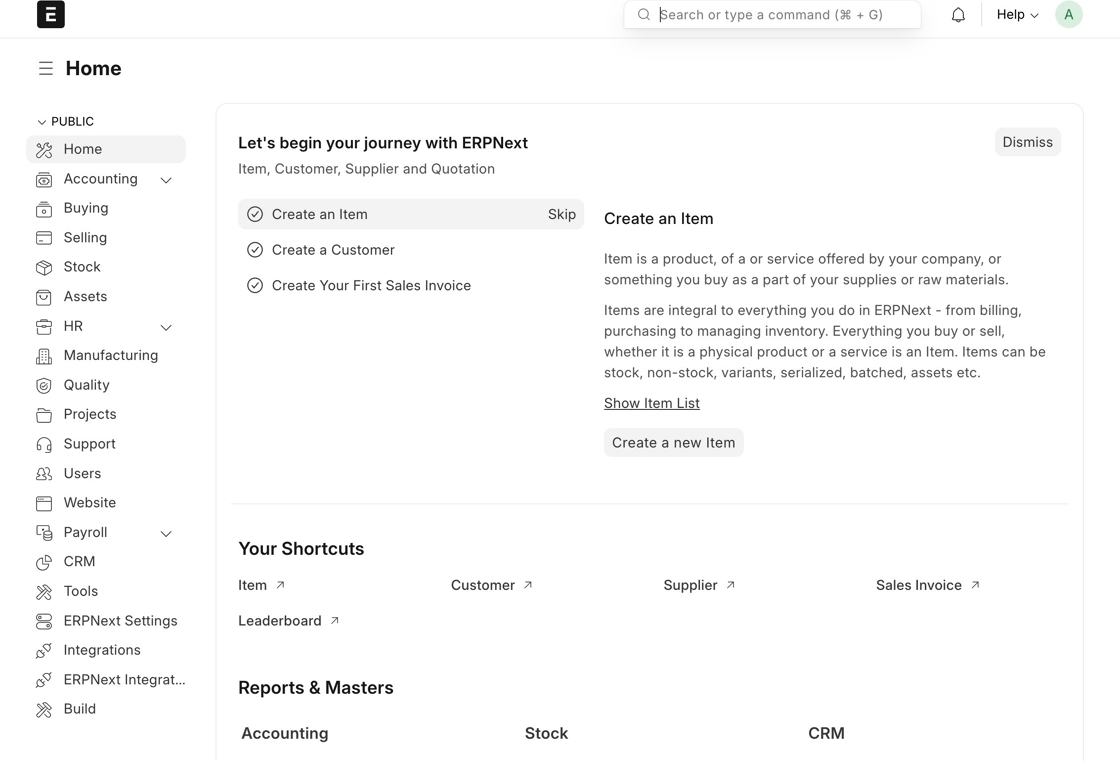

1. Login to the ERP system. You will be presented with the home page

2. Click the "Search or type a command (⌘ + G)" field.

3. Type "zakat", a list of search results will be displayed. Out of which:

4. Click "OUN Zakat Settings"

Tip: In this page, two important fields need to be filled:

-

[Profit Margin] as explained below the field must be entered to aid the Zakat calculator in determinig the value of stock items with no selling price list. As per Sharia, all stock in hand must be evaluated using such stock standard selling price.

-

As per Sharia, stock items that are out of life (i.e., lost their value and cannot be sold) can be exempted from valuation of stock at hand. It is up to the shareholder/owner to decide if they are willing to pay Zakat for expired or unsellable items.

5. Fill the profit margin value that should be applied on unpriced items

6. If you do not want to pay Zakat on unsellable/expired items, click the "Exclude End of Life Materials" field.

7. Click "Save"

Tip: Now we need to fill the owner/shareholder(s) details. For this, we need to open the [Shareholder] list.

8. Click the "Search or type a command (⌘ + G)" field.

9. Type "sharehold"

10. Click "Shareholder List"

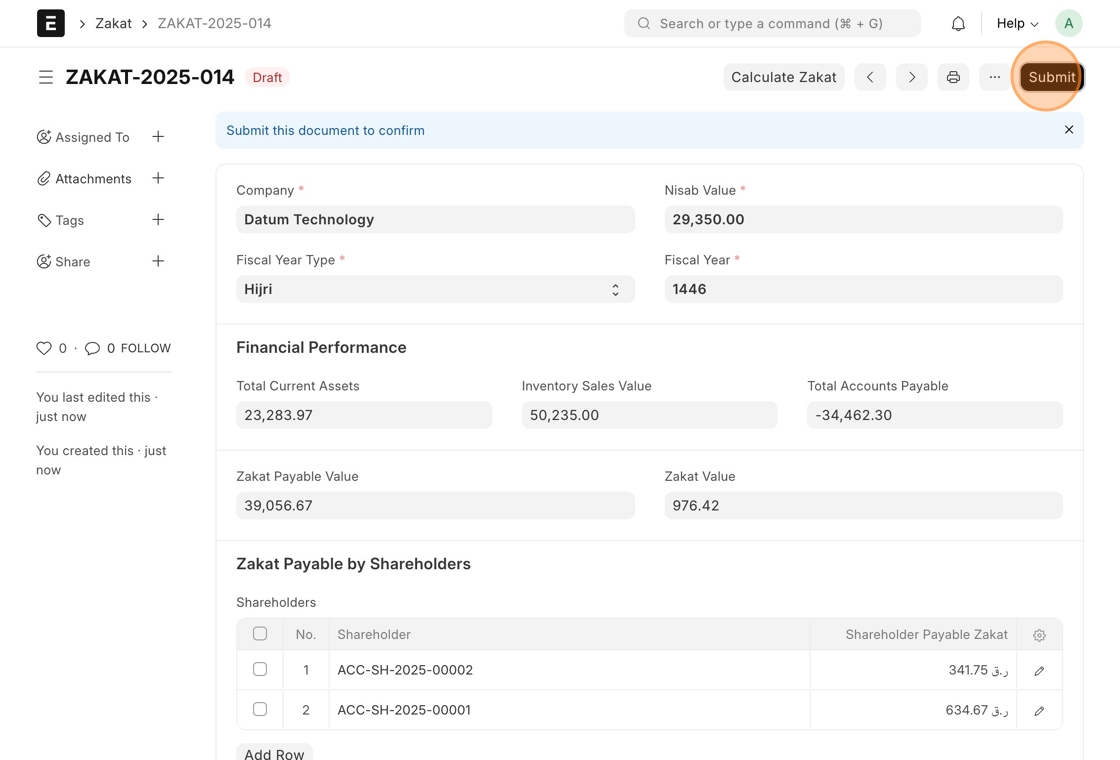

11. The [Shareholder List] page is displayed. Click "Add Shareholder"

12. The [Shareholder] details page will be opened. Filll in the name of the owner/shareholder in the [Title] field.

13. Then, fill the number of shares this shareholders has in the [shares_count] field

14. Once done with the data entry, click "Save"

Tip: You need to repeat steps 11 to 14 for each shareholder. If this is a single owner company/establishment, move to the next step directly.

15. Click the "Search or type a command (⌘ + G)" field.

16. Type "zakat". A list of search result items will be displayed.

17. Click "Zakat List"

18. The [Zakat] list page is displayed. Click "Add Zakat"

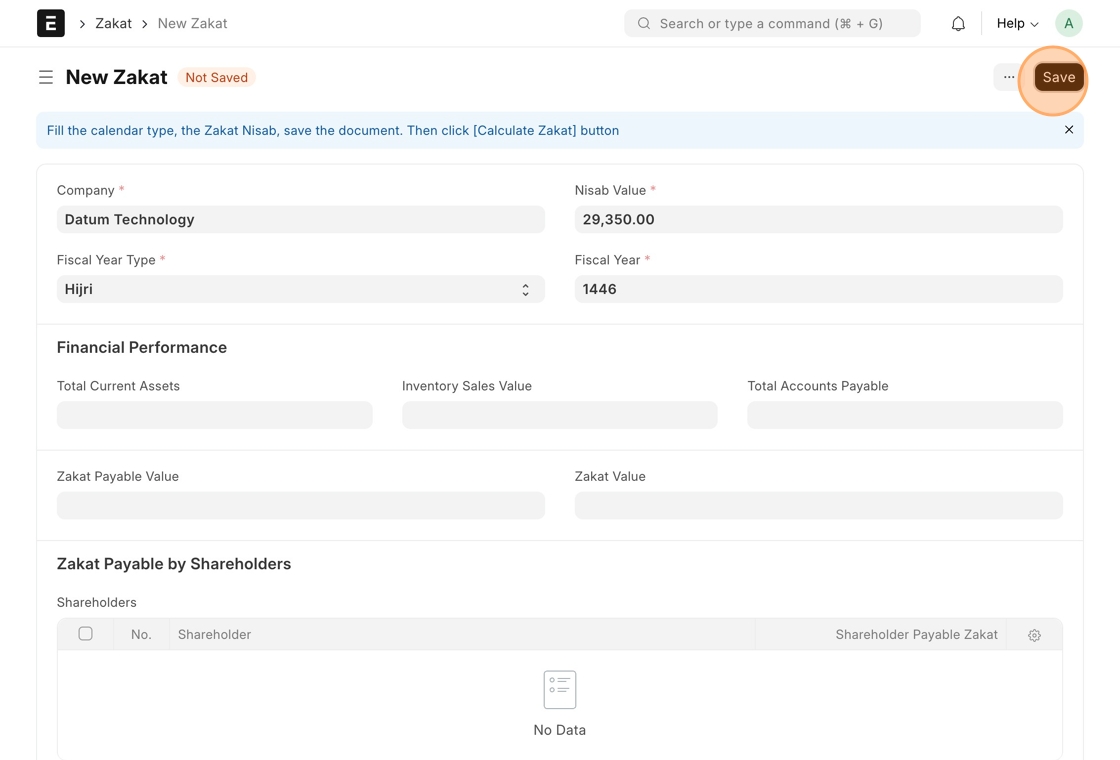

19. Select "Hijri" or "Gregorian" from the [Fiscal Year Type] field

20. Now, fill the Zakat Nisab value for this year. As per Sharia, this the current value of 85g of gold. So, fetch the current cost of 1g of gold, multiply it by 85, then fill the [Nisab Value] with the resulting value.

21. Now fill the [Fiscal Year] value then click [Save]

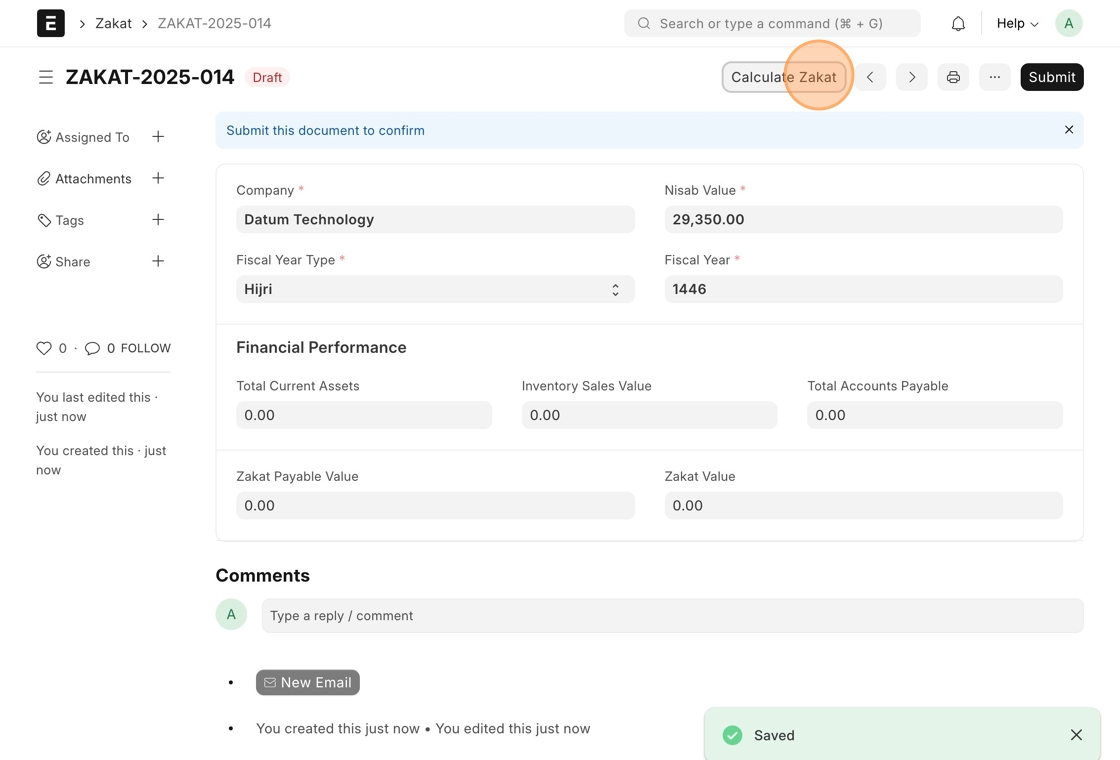

22. Upon saving, the [Calculate Zakat] button will be displayed at the top of the page, click it.

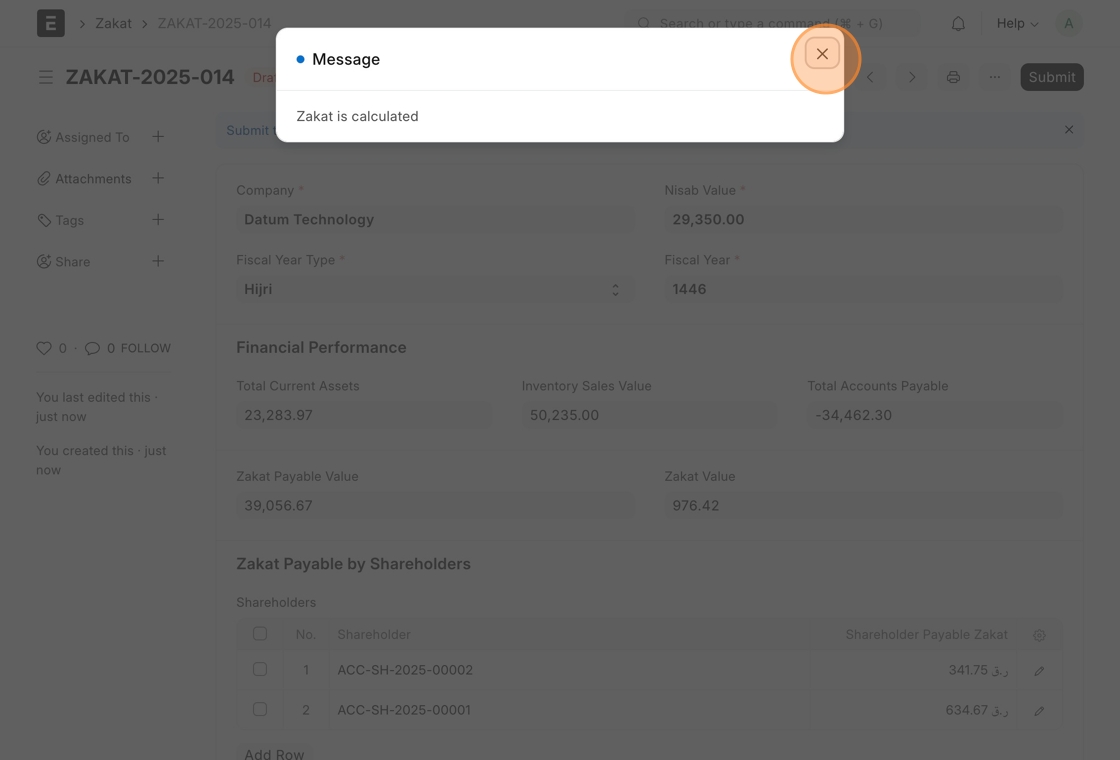

23. The system will calculate the Zakat and upon completing will show the confirmation message

24. The payable Zakat by the company as a whole will be displayed in [Zakat Value] field and a table will be displayed at the bottom of the page showing the [Zakat] value due to be paid by each shareholder as per her/his shares count.

Once you are satisfied with the results, you can permanently save the report output by clicking [Submit] button.

25. Confirm you want to submit the Zakat report by clicking "Yes"

26. Click "Zakat" will take to the [Zakat] list page.